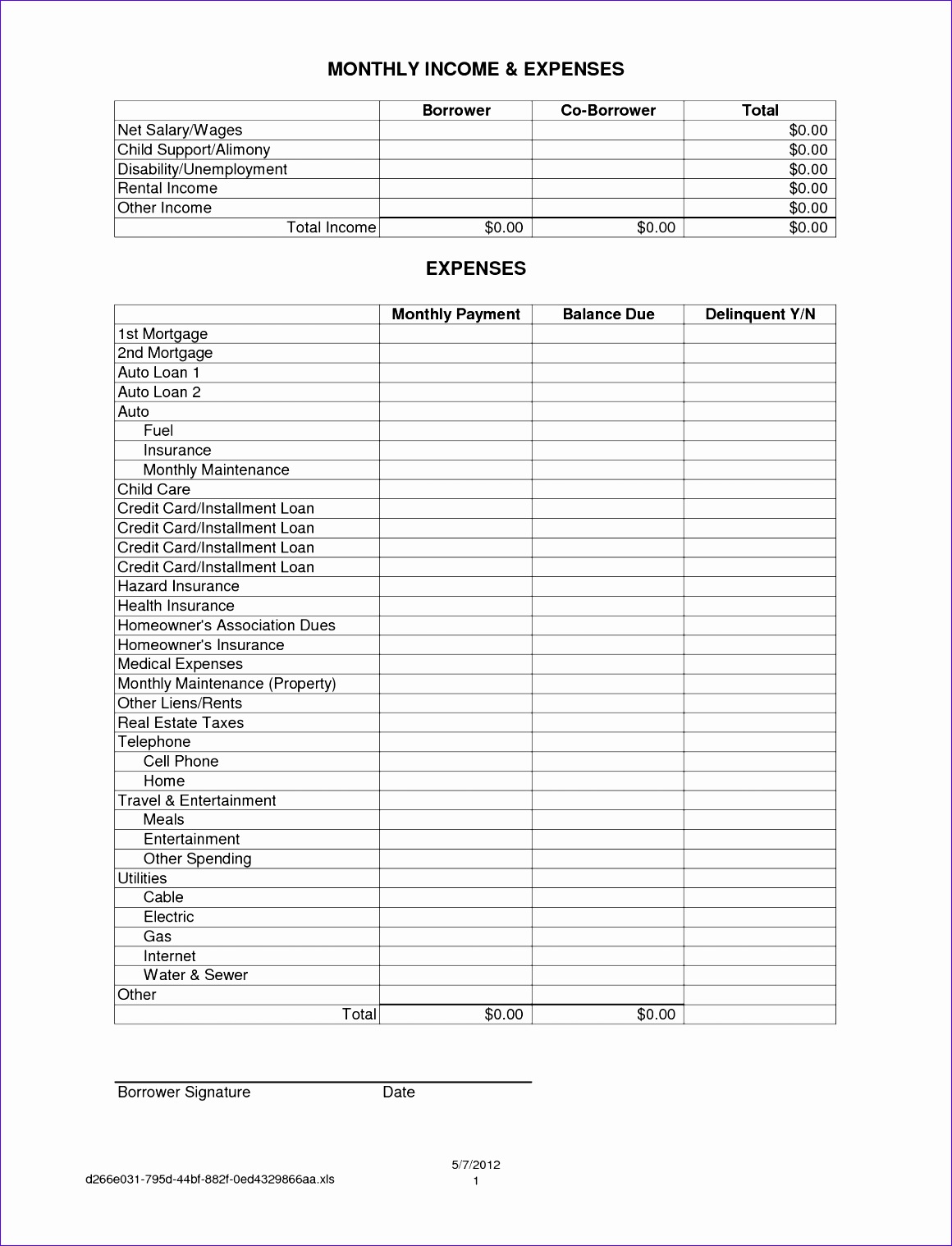

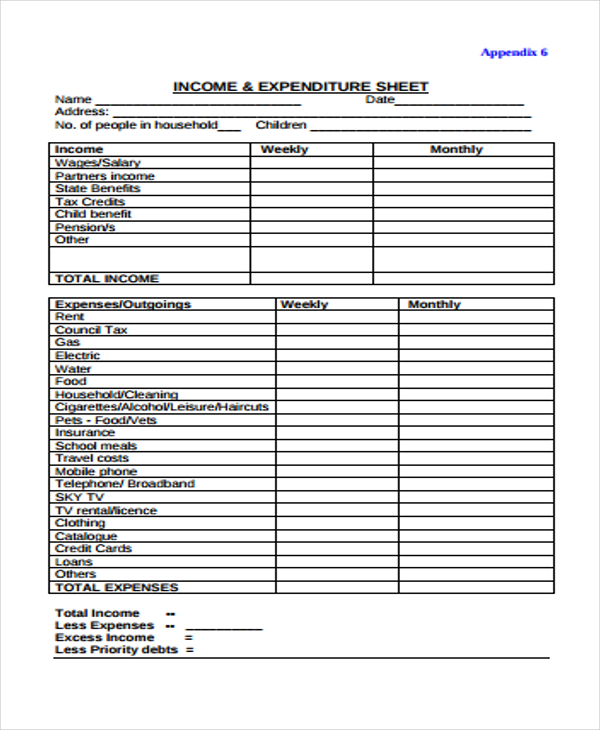

Budget templates also allow you to prepare for slowdowns/busy seasons in the business and allocate your budget to the areas of your company that are in the greatest need of capital. Why is a budget planner template important?īusiness budget templates are essential for a range of reasons, providing you with the ability to plan to meet your financial goals by tracking cash flow, revenue, and expenses. Companies with multiple locations may decide to create a budget template for each location. Profits (i.e., expected sales and income, minus your costs)ĭepending on how comprehensive you want to make your budget planner template, you may also include additional information like amounts/sources of investor funding. Semi-variable costs (i.e., costs that may or may not depend on sales, such as marketing fees) Variable costs (i.e., costs related to sales, such as production expenses) There’s no specific guidance for what needs to be included in a business budget template, but generally speaking, it should hold the following data:įixed costs (i.e., costs that aren’t dependent on sales, such as rent, utilities, or other overheads) First off, what is a budget planner template anyway? What is a budget template?īudget templates are financial documents that provide an estimate of your income and expenditure over a given period.

Find out everything you need to know about business budget templates with our simple guide. Budget planner templates are one of the most important tools for businesses, and while budgeting can be a challenge, monthly budget templates can help make the process run as smoothly as possible.

0 kommentar(er)

0 kommentar(er)